Your FICO® scores (an acronym for Fair Isaac Corporation, the company behind the FICO® score) are credit scores. It’s a sort of grade based on the information contained in your credit reports. Unlike the grades you were given in school — A through F — base FICO® scores generally range from 300 to 850. And the higher, the better.

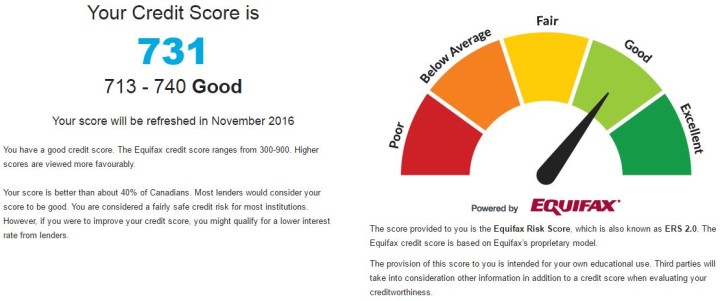

Because there are three major consumer credit bureaus (Equifax, Experian and TransUnion), each with its own version of your credit report, you can also have different credit scores. For example, you can have a FICO® score based on your Equifax® credit report, a FICO® score based on your Experian® credit report, and a FICO® score based on your TransUnion® credit report. To further complicate things, you can also have VantageScore® credit scores from each bureau.

Additionally, FICO also creates many different credit-scoring models for lenders in different industries. So your base FICO® scores may not be the same ones a mortgage lender sees if they request your mortgage-specific FICO® scores, for example.

You probably don’t need to worry about all these nuances when buying a home, but you should still have an idea of what your scores look like. You can get your VantageScore® 3.0 credit scores (based on similar factors to your FICO® scores) from Equifax and TransUnion for free on Credit Karma.

How do my FICO® scores affect my ability to get a mortgage?

Lending a huge amount of money is risky business. That’s why mortgage lenders need a good way to quantify the risk, and your FICO® scores — with all of the data and research that go into them — fit the bill.

Different lenders have different requirements for their loans. And because there are many different types of mortgages from many different types of lenders, there’s no one single minimum FICO® score requirement.

How can my FICO® scores affect my mortgage interest rate?

When a loan officer gets your mortgage application, they may use a pricing grid to figure out how your credit scores affect your interest rate, says Yves-Marc Courtines, a chartered financial analyst with Boundless Advice. Generally, higher scores can mean a lower interest rate, and vice versa.

From there, a mortgage loan officer will likely look at the rest of your loan application to decide whether your base interest rate needs any adjustments. For example, if you’re making a smaller down payment, you may be given a higher interest rate, says Courtines.

A bank’s pricing grid may change on a daily basis depending on market conditions. However, here’s an example of what you might expect your base interest rate to be, based on your credit score, on a $216,000, 30-year, fixed-rate mortgage.